Calculate Value at Risk in R

When β 0 it suggests the portfolio. Apply a present value factor to each ensuing cash flow value calculated as.

Present Value Pmp Exam How To Memorize Things Pmp Exam Prep

From the above data table we are going to calculate the correlation coefficient r.

. Net Asset Value. All investments or securities are subject to systematic risk and therefore it is a non-diversifiable risk. Youll likely find that the cost of replacing your belongings is usually more than their actual cash value.

To simulate this particular environment we assume that we have a series of similar option contracts that commence and expire on a one-day roll-forward basis. When it comes to investment appraisal it can be highly beneficial to know how to calculate net present value. Use a spreadsheet to compile these calculations making it easy to update changes in any assumptions.

The task of risk adjusting the cash flows is very subjective and a combination of both art and science. Calculate the density of your freight shipment with our density calculator tool. The correlation is positive and it appears there is some relationship between height and weight.

And we will verify the manual calculation of r value against the value calculated by Minitab and Excel. This analysis assesses the present fair value of assets projects or companies by taking into account many factors such as inflation risk and cost of capital as well as analyzing the companys future performance. Treasury billNo instrument is completely without some risk including the T-bill which is subject to inflation risk.

Estimate the value at risk VaR for the portfolio by subtracting the initial investment from the calculation in step 4 1 Calculate periodic returns of the stocks in the portfolio. Value at Risk is an industry-wide commonly-used risk assessment technique. Both mutual funds and ETFs calculate the net asset value NAV at 4 pm.

However the T-bill is generally accepted as the best representative of a risk-free security because its return. Read more is as follows. There are two main methods.

Import pandas as pd. As the height increases the weight of the person also appears to be increased. In order to calculate the Value at Risk for options and futures we require a series of returns which in turn requires time-series price data.

Your Open Shipments PRO I098900199 Delivered PRO I098900199. If the two positions were perfectly correlated with r1 the VARs would simply have been additive. Expected return on an asset r a the value to be calculated.

The 1 day VAR would be 5025 and not 4712. Value-at-risk measures apply time series analysis to historical data 0 r 1 r 2 r. For example at month 6 n would equal 6 months divided by 12 months or 05.

α r to construct a joint probability distribution for 1 RThey then exploit the functional relationship θ between 1 P and 1 R to convert that joint distribution into a distribution for 1 PFrom that distribution for 1 P value-at-risk is calculated as illustrated in Exhibit 1 above. Take a look at how to calculate Value at Risk VaR Over 70000 businesses use. Suppose that for the original option the.

Eastern time each trading day. While R2 suggests that 86 of changes in height attributes to changes in weight and 14 are unexplained. Farmers home policies start out with contents coverage equal to 40 percent of your homes.

11rn where r is the discount rate and n equals the time period. The higher the confidence. The confidence interval of a VaR computation is the chance a specific outcome will occur.

Systematic risk is caused by factors that are external to the organization. Discount rate Using a discount rate that includes a risk premium in it to adequately discount the cash flows. Notice that GBPUSD provided a small amount of risk reduction but hardly very much.

DCF Formula CF t 1 r t. When used as a proxy to measure systematic risk the β value of a portfolio can have the following interpretation. That means the 7 day value at risk would have been 13295 from 96023693 and not 12469.

The NAV is the value of each share measured by the value of all the fund. Calculation of Correlation Coefficient r. Calculate the inverse of the normal cumulative distribution PPF with a specified confidence interval standard deviation and mean.

Risk-free rate r f the interest rate available from a risk-free security such as the 13-week US. Find out exactly what you can learn from net present value and get the lowdown on the best net present value formulas to use for your business. Domestic Services Dry Van Expedited Flatbed High-Value High-Risk Intermodal Mexico Transborder Trade Show Logistics Temperature Controlled Full Truckload.

R 2 08651. Risk Adjusting the Intrinsic Value. You may have gotten a great deal on your bedroom set at an estate sale but whats the cost of going out and buying a comparable one today.

Calculating risk scores from quantitative risk analysis such as schedule risk analysis integrated cost and schedule risk analysis and others is both more complex and without any standard process. The reason for the complexity is that the inputs for the analysis are not ranges or labels of ranges but can be expressed in numerous ways.

Forex Signals Stock Trading Strategies Trading Quotes Forex Trading Training

Varioety Of Demo Notebooks Done With R Python And F Jamesigoe Azurenotebooks Master Github Financial

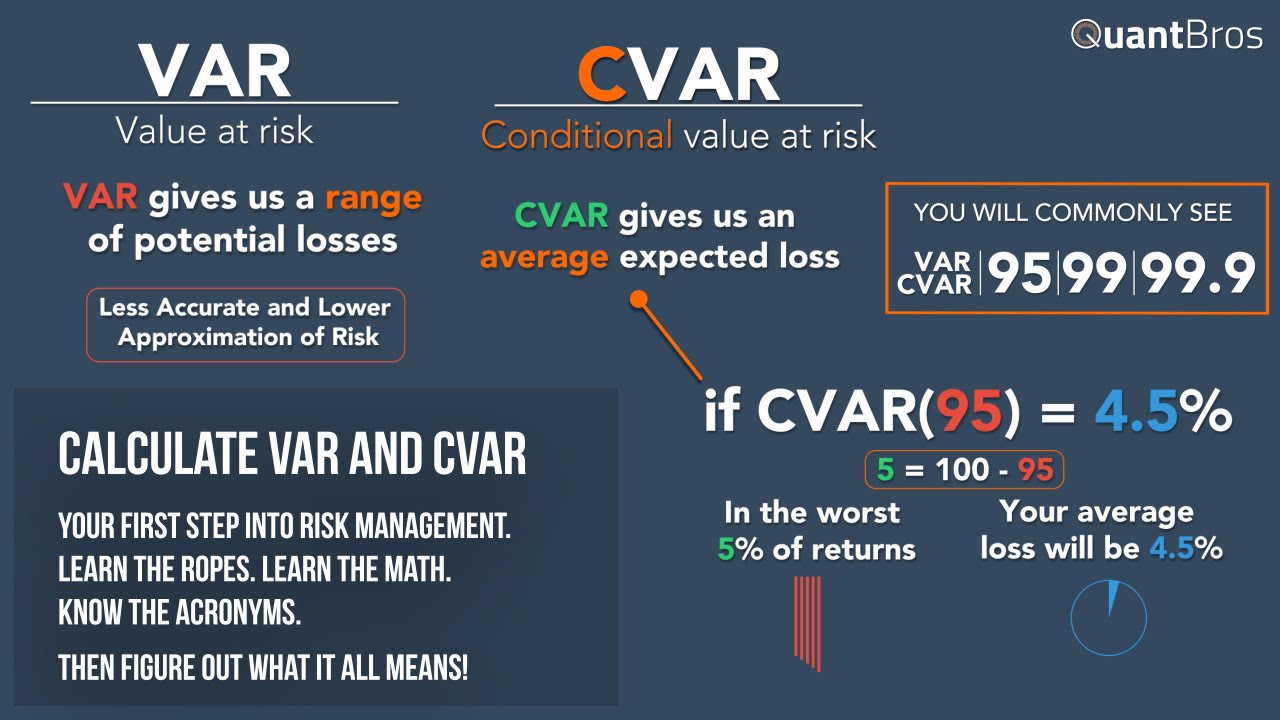

Calculating Var And Cvar In Excel In Under 9 Minutes

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Money Quotes Business Savvy

No comments for "Calculate Value at Risk in R"

Post a Comment